You are currently at

LS Customs

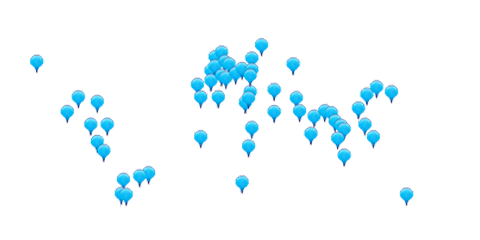

If you are looking for contact information for one of our global offices, please visit the link below.

We can assist with completing duty payment documentation to divert Ship-work End Use and IPR goods to Home use where applicable. These are classed as voluntary declarations and should be completed to bring any outstanding duty and VAT to account. The documentation is completed and submitted to HM Revenue and Customs on your behalf, in accordance with instructions.

Reasons to divert goods to home use:

Trust well placed